THE WATCHLIST

If this company vanished tomorrow, the global semiconductor industry wouldn’t just struggle, it would practically come to a halt. The factories that build the world’s most advanced chips would be left with billion-dollar facilities and major challenges moving forward. AI development would stall. Smartphone innovation would freeze. Governments racing to secure domestic chip supply would suddenly realize their plans are impossible. An invisible gatekeeper controls the narrow doorway every modern chip must pass through, and there is no backup plan. It doesn’t fight for market share, it dictates the terms of the market. This monopoly sits beneath the entire digital economy and almost no one outside the industry realizes how dominant it truly is.

Who is ASML Holding NV (Ticker ASML)?

ASML is one of the most powerful companies in the world. They don’t design chips. They don’t sell consumer products. They sit at a key point of the entire semiconductor ecosystem. Every major chipmaker, TSMC, Intel, Samsung, depends on ASML to stay relevant. When governments talk about “bringing chip manufacturing home,” what they really mean is they need to get access to ASML.

What does ASML do?

ASML builds machines that perform lithography. Think of this as a fancy word for printing the brains of a computer chip.

A computer chip starts as a flat, shiny slice of silicon. It does nothing by itself. To turn it into a chip, you have to draw billions of tiny paths on it, so electricity knows where to go. These paths are what make your phone smart, your car drive itself, and AI actually work.

Lithography is the process of drawing those tiny paths using light.

Those paths are so small that regular light can’t draw them. So ASML invented machines that use a special type of light called extreme ultraviolet (EUV). This light is so powerful and precise, it can carve shapes smaller than a virus.

Here’s what happens so everyone can understand:

Chipmakers take a blank silicon wafer.

ASML’s machine shines EUV light through a stencil.

That light “prints” the tiny brain patterns onto the silicon.

This process repeats thousands of times to build one chip layer by layer.

These machines are huge, cost hundreds of millions of dollars, and take years to install. And there’s no one else on this planet who can make them.

That’s why ASML isn’t just part of the chip industry, they are the gatekeeper to modern computing.

💰 How ASML Makes Money?

ASML makes money in two ways, and both are locked in.

➡ 77% of revenue comes from selling their systems; EUV, DUV, and now the next generation High-NA machines that cost hundreds of millions each.

➡ 23% comes from services; long-term maintenance, upgrades, software, spare parts, and on-site support. Once a customer installs an ASML system, they’re married to it. You don’t swap these machines out. You upgrade them, service them, and build your entire factory around them.

Does ASML have a Wide Durable Moat?

It doesn’t get much better than this. This is one of the widest moats in history. ASML spent more than two decades solving problems no one else could even approach. Their machines require over 100,000 components, extreme-precision optics, and a supply chain that doesn’t exist anywhere else. Their High-NA rollout pushes that lead even further. The competition isn’t one year behind, they are decades behind, if they ever get there at all.

Core Analysis

Market Opportunity

ASML pretty much owns the lithography business that prints chip patterns, and that’s where its market power comes from. In extreme ultraviolet (EUV) lithography, which is required for the most advanced AI, cloud, and smartphone chips, ASML has a 100% share of the market because no other company can make these machines at scale.

In the broader lithography space, including older deep ultraviolet (DUV) systems, ASML controls around 90%+ of the market, with the rest split among Nikon and Canon, but even there, ASML’s tech is the dominant standard because customers favor its higher throughput and roadmap for future nodes. This isn’t just a big share, it’s a monopoly at the core of semiconductor manufacturing.

Market Position

ASML sits at the top of the semiconductor equipment hierarchy, not just a leader, but the indispensable supplier for advanced chips. Everyone from TSMC to Intel and Samsung must buy ASML’s lithography systems to build the latest nodes, so ASML isn’t competing for share in a crowded field, it defines the field. Its technology is so specialized that rivals can’t keep up, and its backlog of orders and customer lock-in give it pricing power and multi-year revenue visibility that few other hardware companies enjoy. In the world of silicon, ASML isn’t just a leader, they’re the gatekeeper.

Revenue Growth

ASML’s revenue has grown robustly, signaling strong demand for its semiconductor lithography systems. This trajectory shows that ASML’s top-line is on an upward trend driven by its technological leadership.

· 2023: €27.6 billion (US$30 billion; +30% YoY)

· 2024: €28.3 billion (US$30.9 billion; +2.5% YoY)

· 2025 (Guidance): €30–35 billion (US$32.5 billion mid-point; +15% YoY)

EPS Growth

ASML’s earnings per share have mirrored the revenue trends. Higher sales and operational leverage showcases strong profitability growth. Overall, ASML remains highly profitable on a per-share basis.

· 2023: €19.91 EPS (basic) (US$21.7; +41% YoY)

· 2024: €19.25 EPS (basic) (US$21.0; –3% YoY)

· 2025 (Est.): Not yet reported (expected to increase with 15% higher sales)

Cash Flow/FCF Margins

ASML generates strong operating cash flows, more than sufficient to fund its investments, making the company free cash flow (FCF) positive. With higher profits expected, 2025 should continue this trend.

· 2023: €5.44 billion cash from operations, €3.3 billion FCF (12% of revenue)

· 2024: €11.17 billion cash from operations, €9.1 billion FCF (32% of revenue)

· 2025: Full-year data pending – continued positive FCF anticipated (2024 year-end cash ↑ to €12.7 billion)

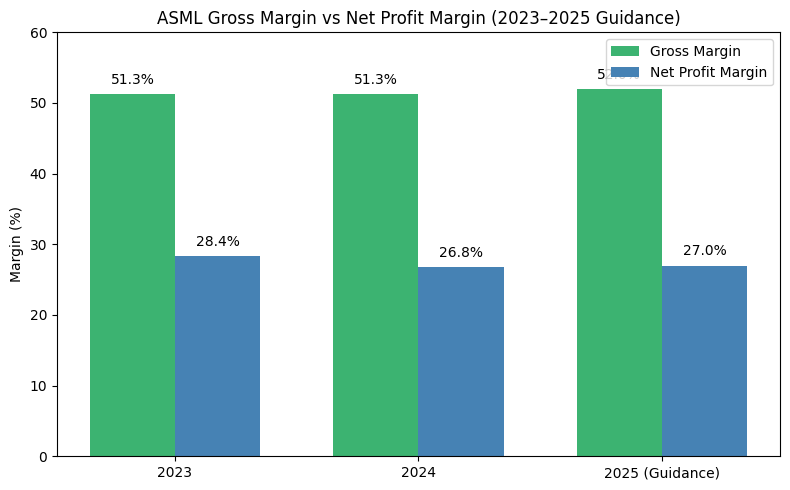

Gross & Profit Margins

ASML maintains exceptionally high margins, highlighting its pricing power as the dominant EUV tool supplier. Overall, these solid margins underscore ASML’s ability to command premium prices and manage expenses.

· 2023: Gross margin 51.3%; Net margin 28.4%

· 2024: Gross margin 51.3%; Net margin 26.8%

· 2025 (Guidance): Gross margin 52%; Net margin 27% expected

Balance Sheet Strength

ASML’s balance sheet is very strong, with a large cash reserve and relatively low debt, indicating ongoing balance sheet strength. Such liquidity and low leverage provide ASML resilience and strategic optionality for investments or downturns.

· FY 2023: Cash €7.0 billion; Long-term debt €4.6 billion

· FY 2024: Cash €12.7 billion; Long-term debt €3.7 billion

· Q3 2025: Cash €5.1 billion; Long-term debt €3.7 billion

Institutional Ownership:

About 18–19% of ASML’s shares show up as institutionally held on U.S. tracking sites, but that number is misleading. ASML is a Dutch company with most ownership sitting in European pension funds, sovereign wealth funds, and global ETFs that don’t report through U.S. systems, so the real institutional ownership is far higher than what American databases display.

Why ASML Looks Good 📈📈📈

· Almost every advanced chip in the world must pass through ASML’s machines before it can exist

· High-NA machines will open up a new decade of growth.

· Governments are pouring money into domestic chip capacity.

· Their backlog stays strong even in slow cycles.

· Every node shrink makes ASML more essential.

Why ASML Can Be Concerning 📉📉📉

· China export restrictions cap part of their growth.

· Any delay in High-NA would ripple through earnings.

· Chip demand still moves in cycles, even with AI.

· A handful of mega customers control most of their revenue.

· The stock is already priced for near-perfect execution.

Scenario Analysis

🟢Bull Case

AI demand keeps accelerating and every major chipmaker rushes to expand advanced-node capacity at the same time. High-NA EUV launches smoothly, letting ASML sell fewer machines at dramatically higher prices while expanding margins. Governments keep funding domestic fabs, China restrictions don’t materially worsen, and ASML becomes less cyclical and more utility-like. In this world, ASML isn’t a chip equipment company anymore, it becomes critical global infrastructure with sustained double-digit growth for the next decade.

🟡 Base Case

AI continues growing, but in waves. High-NA rolls out mostly on schedule with normal hiccups, and customers upgrade gradually instead of all at once. China remains a capped but manageable market, while U.S., Europe, and Asia offset with steady fab investment. Growth stays healthy but uneven, and ASML continues to compound slowly as the backbone of advanced manufacturing, not explosive, but durable.

🔴 Bear Case

High-NA gets delayed or adoption is slower than expected and a broader semiconductor downturn hits capital spending hard. Export restrictions tighten further, cutting off a larger portion of China revenue, and mega-customers pause orders at the same time. ASML remains the technology leader, but earnings flatten for several years, and the stock underperforms as investors reprice perfection.

Zoom Out: 5 & 10 Year Outlook

Over the next five years, ASML should remain the backbone of advanced semiconductor manufacturing. They’ll continue to see growth driven by AI datacenter demand and elevated capex from TSMC, Samsung, and Intel. High-NA EUV machines will have meaningful revenue contributions, pushing ASPs higher and expanding margins. Services will grow as installed fleets get older and more complex. China will likely remain constrained but offset by spending in the U.S., Europe, and Asia. Overall, you can probably expect mid to high teens revenue growth with expanding margins and strong free cash flow with slower downcycles stronger upcycles.

A decade out, ASML should be even more entrenched. High-NA EUV will be standard for cutting-edge nodes, and the installed base of advanced lithography tools will be enormous. ASML isn’t just selling machines by then, it’s selling recurring revenue in upgrades, software, and lifecycle support on decades-long technology footprints. National chip initiatives around the world will ensure a growing, diversified customer base. The company will likely broaden its technological lead and pricing power, which will make it one of the most durable industrial compounders in existence.

The Risks…

ASML’s position is enviable, but not without risks…

➡ Export controls, especially to China, could tighten and constrain growth.

➡ Lack of Recurring Revenue

➡ Valuation priced for perfection, anyting less could mean contraction.

➡ Delays or technical setbacks in High-NA EUV could also slow near-term earnings.

➡ The semiconductor capex cycle still swings, customers can pull spending hard and fast. A concentrated customer base means order volatility. Customer Concentration limited to several big players with TSMC being a large portion

The Bottom line: ASML isn’t your typical semiconductor equipment play, it’s the critical infrastructure of modern and future compute. Its machines are the only tools capable of producing the most advanced chips on earth. That gives it pricing power, recurring services revenue, and the strongest competitive position. But export policy, cycle timing, and execution on next-gen technology are real watch items. For long-term investors, ASML looks like one of the rare global compounders tied to the biggest secular trend in tech, the relentless demand for compute.

My Take

I am a shareholder of ASML with high conviction. This isn’t a stock that’s going to grow revenue at 40% YOY, but expect them to stack cash and continue to dominate. They own the market with no competition.