- HappyStocks

- Posts

- One of the Best Comeback Stories - But is the Risk Gone?

One of the Best Comeback Stories - But is the Risk Gone?

The Watchlist Investor Report

THE WATCHLIST

My relationship with this company has been… complicated. I went on a wild ride; bought around $230, watched it collapse into single digits, and then watched it climb all the way back. In the end, I sold for no profit, and for one reason only: I had broken my own rule of buying a business that depended heavily on debt. Today, the balance sheet looks a lot healthier, the story has evolved, and it’s earned its way back onto my watchlist.

Help us become the fastest growth stock newsletter:

Share HappyStocks with Friends

This is about a company that nearly broke under its own weight…and what happens when a leverage-heavy model gets a second chance.

The used car market is huge and always moving, but it swings with the economy. Auto loans have ballooned over the years, and with higher rates and stretched consumers, you can see why this is such a cyclical business. When credit is easy, demand looks unstoppable, and when it tightens, the cracks show fast.

What makes Carvana interesting is the comeback. Few companies have fallen this hard and fought their way back, but it’s still a leverage-heavy model where wins can be big and mistakes can be painful.

Enjoy the Read – and make sure to check out the new Financial Score Card

Here’s a sneak peek at my current holdings.

Who is Carvana (Ticker CVNA) and

What Do They Do?

CVNA is an online-first used auto retailer built around a vertically integrated “buy online + deliver/pick-up” experience, backed by its own reconditioning and logistics infrastructure. Think dealership, rebuilt for e-commerce. Customers can browse inventory, view 360° imaging, secure financing, add protection products, and complete the purchase without stepping onto a lot. Delivery happens through a hub-and-spoke logistics network, either to your home or to one of their branded pickup locations, including the car vending machines. They also offer a 7-day return window to reduce friction and increase conversion.

CVNA controls sourcing, inspection and reconditioning, merchandising, logistics, and post-sale support. They monetize beyond the vehicle itself through financing, loan sales and securitizations, plus add-on products like service contracts and GAP coverage. The strategy is scale-driven: better experience drives more units, more units improve cost absorption and inventory depth, which improves margins and selection. The real question with CVNA is whether that flywheel produces durable unit economics at scale.

If you’re analyzing CVNA, focus on:

· Units sold

· GPU (gross profit per unit)

· Reconditioning and logistics efficiency

· Financing performance and credit risk

· Fixed cost absorption

💰️How CVNA Makes Money?

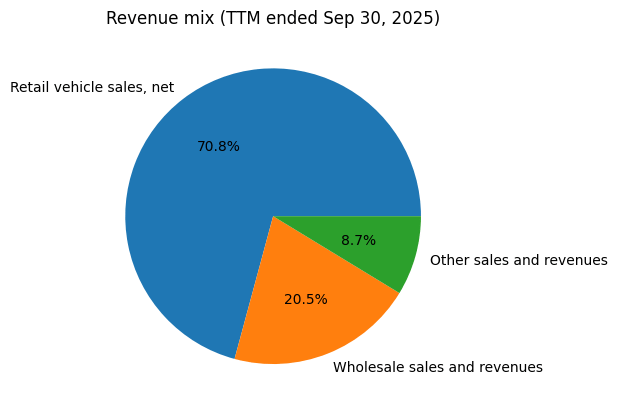

They break revenue into three buckets: retail vehicle sales, wholesale sales, and “other.”

Retail is the core business. Selling used cars directly to consumers online.

Wholesale is everything that doesn’t make the retail cut. Trade-ins or acquired vehicles that fail their retail standards get sold at auction. This bucket also includes marketplace fees from third-party sellers using their auction platform.

“Other” is where it gets interesting.

This is primarily loan-sale economics. They originate auto loans, then sell those receivables into securitizations or to financing partners and recognize gains on sale. There’s also some interest income before those loans are sold. On top of that, they earn commissions from vehicle service contracts, GAP waivers, and auto insurance partnerships.

One important eyecatcher from their Q3 2025 filing: they describe “Other” as 100 percent gross margin. Gross profit equals revenue in that bucket. That’s why investors fixate on growing “other” revenue per unit. It scales cleanly and drops straight to gross profit.

When you model CVNA, don’t just look at revenue growth. The business gets more interesting as “other” scales per unit.

Does CVNA have a Wide Durable Moat?

Short answer: It has a moat. Wide and untouchable? Not yet.

CVNA edge is its vertically integrated e-commerce model. It controls pricing and financing algorithms, owns the reconditioning process, and runs its own logistics network. That matters. More control means tighter cost management and a cleaner customer experience.

The physical infrastructure is real. The company says it has capacity to recondition roughly 1 million vehicles per year, with added footprint from the ADESA U.S. acquisition. As of year-end 2024, about 75% of the U.S. population lives within 100 miles of one of its inspection or auction sites. That density supports faster, more reliable delivery.

So where exactly is the moat?

It’s scale plus process plus infrastructure plus data. The more volume they push through the system, the better their cost per unit should get. That flywheel can be powerful.

But this isn’t a patent or a regulatory lockout. Used cars are highly competitive and price transparent. Customers compare listings in seconds. If someone else can match price and convenience, loyalty fades fast.

The real test is whether CVNA keep lowering cost per unit and improving delivery speed faster than competitors can justify copying the spend?

And can that advantage hold up in a downturn, when demand drops and credit tightens?

If the cost structure keeps separating, the moat widens.

If it compresses back toward the industry, it shrinks.

Market Opportunity & Position

Market Opportunity: CVNA has yet to tap the surface. The U.S. auto market is huge. Roughly 40 million used cars and 16 million new cars are sold each year. Even if you ignore new cars and just look at used retail, you’re talking about around 36 million transactions annually. And it’s fragmented. The top 10 retailers control less than 10% of the market. That leaves a lot of room for a scaled, national player to take share, especially as more buyers get comfortable purchasing online. There’s also leverage beyond just selling cars. Each unit can generate financing and wholesale revenue. So when volume grows, multiple revenue streams grow with it. It’s still cyclical. Auto demand always is. But when your starting market is this big, even moving from 1% to 2% share is meaningful.

Market Position: CVNA is still small relative to the market. About 1.5% of U.S. used cars. Around 1% of the total auto market. It’s not the overall market leader in used cars. But it is the largest pure online used car retailer in the U.S., which is the lane it cares about. Infrastructure is scaling. By year-end 2025, management expects built capacity for 1.5M+ annual retail units, with expansion underway across multiple ADESA sites. Recent traction has been real. Customer satisfaction is strong too.

Bottom line: national scale, improving economics, still early in share. That’s why the stock moves hard with each quarter.

Core Analysis

➡️ Total Score: 40 / 50

➡️ Average Score: 8 / 10

Revenue Growth: has reaccelerated strongly after the 2023 reset

CVNA went through a contraction phase but has clearly re-entered a strong growth cycle with record revenue levels and accelerating unit growth into 2025. The business is now materially larger than during the downturn and showing strong operating leverage.

EPS Growth: massive turnaround from losses to strong profitability

The earnings story is one of the biggest improvements, moving from heavy losses to meaningful profitability driven by cost discipline and operating leverage. EPS growth is driven more by margin expansion than pure revenue growth.

Cash Flow: is clearly positive after restructuring

CVNA has crossed the most important threshold: sustainable positive operating and free cash flow, which reduces financial risk compared to prior years. FCF Margins are slightly positive but still thin due to working capital intensity.

Margins: show dramatic improvement but are still mid-range

Margins improved significantly thanks to cost discipline and scale, but auto retail remains a structurally lower-margin industry

Balance Sheet (Cash/Debt): is much healthier but still leveraged

The balance sheet has improved significantly after debt restructuring and repayments, but the company still carries meaningful leverage.

Why CVNA Looks Good 📈📈📈

• Q3 2025 proved the model can generate real GAAP profit at scale. $263M net income. $552M operating income. While units grew 44% YoY.

• “Other” revenue carries ~100% gross margin and scales with each car sold. That supports per-unit economics even if vehicle spreads compress.

• The heavy infrastructure is largely built. The next phase is utilization and staffing, not massive new capex.

• Execution is tangible. More ADESA production lines, deeper inventory pools, faster delivery times. Operational levers, not branding.

• S&P 500 inclusion adds credibility and brings steady index fund ownership.

Why CVNA Can Be Concerning 📉📉📉

• The model is tied to credit markets. “Other” revenue depends on loan origination and securitization. If spreads widen or capital tightens, earnings can swing fast.

• Related-party complexity is real. DriveTime, tied to the Garcia family, is a disclosed related party and administers VSCs sold on the platform.

• Fair-value accounting adds noise. Q3 2025 included a $120M negative swing from Root warrants alone.

• Debt still matters. Interest expense, refinancing risk, and debt repurchases remain ongoing variables.

• Competition isn’t light. They’re up against traditional dealers, CarMax-type operators, and large online ecosystems, including Amazon.

Scenario Analysis

🟢Bull Case: CVNA keeps growing units at high double digits and drives down cost per unit as volume scales. ADESA capacity gets filled, not just built. Fixed costs spread over more cars. Financing markets stay healthy, so “Other” revenue keeps compounding at high margin. The 3M units at 13.5% EBITDA target starts to look realistic. They prove margins can hold up through a softer demand period. The market values them like a scaled national retailer, not a cyclical dealer.

🟡 Base Case: They keep taking share, but growth slows as early efficiency gains taper off. ADESA ramps, but utilization builds gradually. Margins stay solid, though loan spreads and rates create quarterly noise. They become a strong national player, just short of the 3M-unit stretch goal this decade. The stock stays volatile as investors debate how durable margins really are.

🔴 Bear Case: Used car demand weakens or credit tightens. “Other” revenue drops when it’s needed most. Vehicle prices and turn times move the wrong way. GPU compresses. Costs don’t fall fast enough. ADESA capacity is underutilized, flipping operating leverage into a headwind. Governance or related-party issues resurface and raise the cost of capital. They remain a player, but the scale story doesn’t translate into stable through-cycle returns.

Zoom Out: 5 & 10 Year Outlook

The next five years are about making current profitability repeatable. They need to prove earnings hold up across a full cycle while increasing utilization of the network they’ve already built. Expect growth to stay a priority, with leverage coming from higher throughput, not massive new capex.

A decade out, it splits two ways. Either CVNA becomes a true national scale player, moving meaningfully toward the 3M-unit ambition. Or it settles into a profitable but cyclical operator, constrained by credit markets and competition.

The Risks…

➡️ Credit markets. “Other” depends on loan sales and securitization spreads.

➡️ Macro and affordability. Rates and used car prices directly hit demand.

➡️ Execution at scale. Underutilized recon and logistics capacity kills leverage.

➡️ Governance overhang. The DriveTime and Garcia structure can pressure perception and cost of capital.

➡️ Competition. Dealers, CarMax-style players, and large online ecosystems compete hard on price and convenience.

➡️ Accounting noise. Fair-value swings can distort earnings and move the stock.

The Bottom line: CVNA is a scale machine in a huge, fragmented market. Small share gains can drive outsized growth. Retail sales are still the bulk of revenue. Long-term margin expansion depends on scaling high-margin “Other” and squeezing more efficiency from logistics and recon. This isn’t a set-and-forget wide moat. It’s a moat you earn by executing well and staying aligned with credit markets. If they approach even a fraction of 3M units without balance sheet stress, the upside is clear. If credit tightens or unit economics slip, the downside is just as clear.

My Take

I do not own CVNA, but it’s peaked my interest once again. I’ve always loved the model, and I believe this is a huge market they can tap into and be the “Ecommerce” leader for the space. Assuming they continue to improve their cash/debt ratio and margins, they could be a force for years to come.

Are you Bullish or Bearish on CVNA? |

Reply