THE WATCHLIST

For years, they were written off as a joke. They were known as the flashy app for beginners and hype traders. But under the hood (pun intended), the business has been evolving. Robinhood isn’t just for meme traders anymore.

With record net interest revenue, growing cash flow, and a huge user base that’s now serious about investing, Robinhood is turning into something not many expected: a real, profitable fintech. They’re starting to look like a financial platform built for the long haul.

HappyStocks alert 😄📈 Pay close attention to this one...

Why is Robinhood a Top Stock in my Watchlist?

I don’t own Robinhood (Ticker: HOOD), but that’s likely to change very soon.

HOOD’s comeback isn’t about hype, it’s about results. After years of being written off as a “meme app,” the company has quietly built a stronger, leaner, and more predictable business.

They’ve posted multiple profitable quarters, seen a sharp rise in interest income, higher cash yields, and better cost control. They’re growing assets under custody, expanding into new products like IRAs and credit cards, and re-engaging users who once left. They’re a maturing platform, not just a fad.

Going global and expanding beyond the U.S. is the real unlock. This gives HOOD a shot at scaling to tens of millions of users worldwide.

The combination of growth and optionality makes HOOD interesting. They’re still early in building out new revenue streams, including subscriptions, retirement products, and banking services, but each of those has the potential to compound over time. And unlike 2021, the business now has real cash flow to fund that growth without taking on heavy debt.

Another reason they stand out; HOOD owns its audience. Their customer base is young, loyal, and growing up financially. As those users earn more and invest more, HOOD’s average account value will rise, which means more interest income, more Gold members, and better long-term retention.

I’ll admit, I wasn’t a fan a few years ago. But now, I see a great turnaround story. The noise is gone, the foundation is stronger, and the business model is aligned with profitability and their vision.

If they can keep execution tight and continue converting users into long-term investors, HOOD will go from a trading app into one of the most valuable fintech platforms of the decade.

Who is Robinhood?

HOOD was founded in 2013 by Vlad Tenev and Baiju Bhatt. The company’s mission was bold: to “democratize finance for all.” It gave everyone a way to easily invest in stocks and crypto right from their phones

In 2021, HOOD went public, and even though they were seen as the “meme stock app,” they have grown into something much more serious. HOOD now manages over $100 billion in assets under custody and serves more than 20 million users, most of them younger, first-time investors.

HOOD is known for pioneering commission‑free stock & crypto trading through a user‑friendly, mobile‑first experience. They became the first platform that made investing approachable. No suits. No jargon. Just an app, a few taps, and you owned your first stock. That accessibility changed the stock brokerage industry, forcing the biggest names in the space to drop commissions just to compete.

What Does HOOD Do?

HOOD started as a simple stock trading app but has grown into a broader fintech financial platform designed to help users save, invest, and spend all within one ecosystem.

Here’s what they offer today:

Stock, ETF, and Options Trading — all commission-free through their mobile and web app.

Crypto Trading — users can buy and sell major cryptocurrencies within the same app.

Retirement Accounts (IRAs) — including a unique 1% match for user contributions.

Cash Management — lets users earn interest on uninvested cash (up to 5% for Gold members).

Robinhood Gold — a $5/month premium subscription that includes margin investing and higher cash yields.

Credit Card — their latest product rollout offers cash back on spending and deeper integration into the HOOD ecosystem.

HOOD’s goal now is to become a “money super app” where users can do everything from earning yield on cash to investing for retirement to paying bills or spending rewards, all inside one platform.

This is a big shift from the early meme stock days. The company has matured, diversified its income, and built a clear path to sustainable profitability.

💰 How HOOD Makes Money?

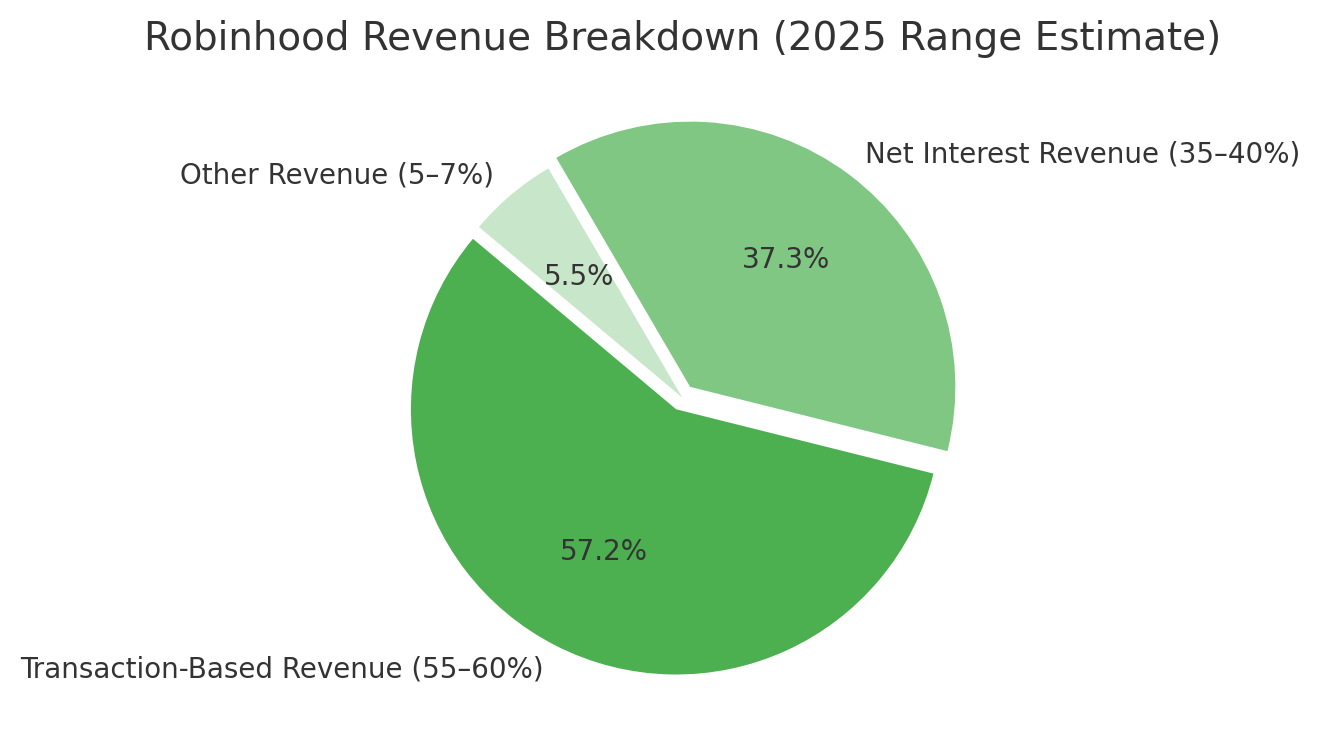

HOOD has three main sources of revenue; trading, interest income, and everything else.

1. Transaction-Based Revenue (55–60%)

This comes from activity on the platform: stock, option, and crypto trades.

Options trading is the biggest part of this category, making up roughly half of all transaction revenue.

Equities trading contributes less, since trades are commission-free, but HOOD earns small payments through a process called Payment for Order Flow (PFOF).

Crypto trading adds another layer of volatility, strong during high-interest cycles, but weaker when crypto volumes fall.

Payment for Order Flow is worth explaining; when you make a trade, HOOD routes it to large market makers (like Citadel Securities or Virtu) that execute it. Those firms pay HOOD small rebates for sending the order their way. Your personal info isn’t sold or shared, but it’s a way HOOD earns from the trade flow itself.

2. Net Interest Revenue (35–40%)

As interest rates have climbed, this has become HOOD’s most stable and fastest-growing source of income. They earn interest in a few ways:

On cash balances sitting in customer accounts.

On margin loans (money borrowed by users to trade).

From lending out securities to other financial institutions.

This side of the business has made HOOD look more like a bank than a trading app. In 2021, interest income was a small piece of revenue. Today, nearly half. That’s a huge shift and a big reason why the company is posting consistent profits.

3. Other Revenue (5–7%)

This includes subscriptions (like HOOD Gold), account transfer fees, new banking products, and the recently launched credit card. It’s still a smaller piece of the pie, but it’s also the most promising for long-term growth because it’s recurring and not tied to daily trading activity.

Does HOOD have a Wide Durable Moat?

HOOD has a moat. I wouldn’t call it a wide moat, but it’s growing. Here’s a look…

1. Brand & First Mover Trust – HOOD became the first investing app for millions of young investors. That early relationship creates habit and loyalty, which can be hard for competitors to duplicate.

2. Low-Cost, Mobile-First Platform – Their digital-only model keeps costs low and margins high. No branches, no legacy systems…just a fast, simple app that’s built for the next generation.

3. Expanding Ecosystem – With IRAs, cash management, Gold memberships, and now a credit card, HOOD is building a full financial home for users. The more products people use, the harder it becomes to leave.

Bottom line: the moat is still narrow, but it’s getting stronger as users grow, stick around longer, and keep more of their financial lives inside the HOOD ecosystem.

What Could Widen the Moat?

Nothing HOOD offers is impossible to copy. But the moat widens when all the pieces connect and users stop needing to go anywhere else.

1. Ecosystem Integration – Trading, saving, and spending inside one app makes the experience effortless. It’s not about having unique products, it’s about removing friction so users stay by choice.

2. Brand and Habit Lock-In – Millions started their investing journey on HOOD. As they add IRAs, cash yield, and a credit card under the same roof, the habit deepens. Over time, switching feels inconvenient, and that’s where stickiness can turn into a strong moat.

3. Data and Personalization – The more users do within the app, the smarter HOOD gets about how they invest and save. That can lead to better recommendations, custom yield programs, and personal offers. These are things competitors can copy, but not duplicate at the same scale.

Bottom line: HOOD’s moat won’t come from having the most products, it’ll come from having the most seamless experience for the next generation of investors.

What about Prediction Markets?

HOOD is stepping into one of the most interesting plays it’s made in years: prediction markets.

While many have called for HOOD to become a “traditional brokerage”, they have instead doubled down on what its core users actually want: accessible, fast-moving, and exciting. Prediction markets aren’t a pivot, they’re a continuation. HOOD keeps building for the retail crowd that treats markets as both opportunity and entertainment.

Instead of just trading stocks, users can now bet on outcomes for a variety of events, including sports, elections, economic reports, fed target interest rates, etc. This unlocks a different kind of engagement. Faster, more event-driven, but also more entertainment than investing.

It also puts HOOD in direct competition with companies like DraftKings and FanDuel, while expanding its reach beyond traditional retail finance.

If the model sticks and regulation doesn’t get in the way, this move will diversify Robinhood’s revenue mix, widen its moat, and turn the platform into a broader engine for retail speculation.

Core Analysis

Market Opportunity

There’s no shortage of business here. HOOD operates in a massive addressable market of retail investing, personal finance, and cryptocurrency trading. The company’s vision is to “enable anyone, anywhere, to buy, sell, or hold any financial asset”, giving them a huge global opportunity beyond their current U.S. base.

Market Position

HOOD has become a leading retail brokerage platform. That said, traditional brokerages like Schwab, Interactive Brokers, and Fidelity still control the majority of assets and trading volume. HOOD’s average account size is smaller and is a fraction of the total market in terms of overall client assets. However, with a strong brand among younger investors and ongoing diversification into options, crypto, and cash management, HOOD has carved out a solid market position.

Revenue Growth

2022: $1.36b

2023: $1.87b (+37%)

2024: $2.95b (+58%)

Recent revenue growth shows how HOOD’s business responded to higher interest income and increased transaction volumes (especially crypto) after the 2022 dip.

EPS Growth

2022: EPS –$1.17 (net loss $1.03 billion)

2023: EPS –$0.61 (+47.9% eps growth - net loss $541 million)

2024: EPS +$1.56 (+355.7% eps growth - net income $1.41 billion)

So they’ve gone from deep losses in 2021–22 to full‑year profitability in 2024.

Cash Flow/FCF Margins

2022 FCF: negative ($909 million) free cash flow

2023 FCF: $1.16 billion free cash flow (62% FCF margin)

2024 FCF: negative ($207 million) free cash flow (-7% of revenue)

2024 had a slight free cash flow deficit due to timing/one‑offs. In short, strong turnaround in cash generation with 2023 as a standout year.

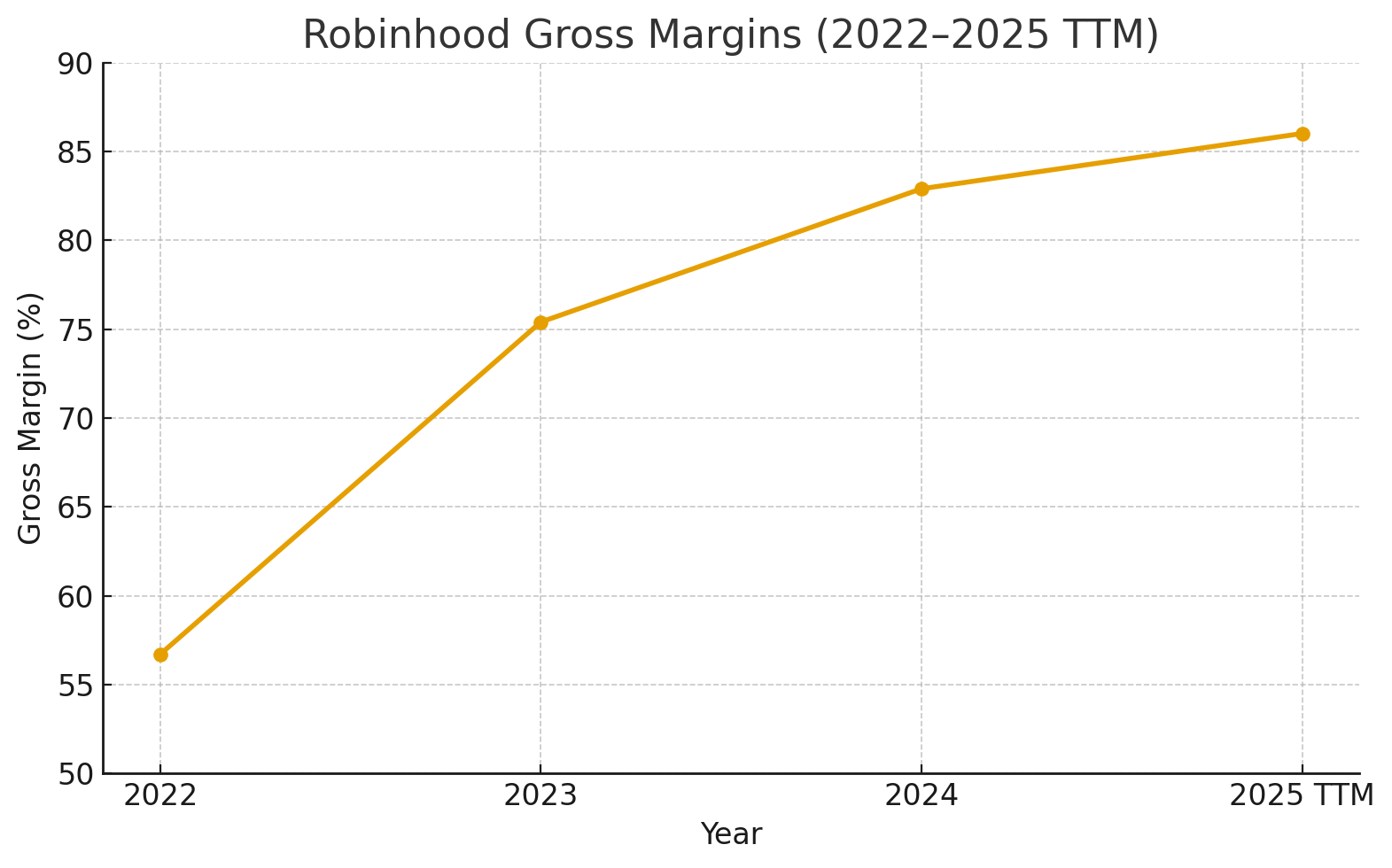

Gross & Profit Margins

Gross margins have been on fire as interest revenue has been growing significantly.

2022: 56.7%

2023: 75.4%

2024: 82.9%

2025 TTM: 86.01%.

2022: ‑76% profit margins

2023: ‑29% profit margins

2024: +48% profit margins

So high gross margins + improving profit margins as scale kicked in.

Pricing Power

HOOD’s core business has limited pricing power since commission‑free trading is the norm, so raising fees on basic trades isn’t an option. Revenue growth is driven by volume/user growth and backend monetization (payment for order flow, cash interest, premium services). Uplift has to come from new features or higher usage, not fee increases.

Balance Sheet: Cash & Debt

Q3 2025: Cash & cash equivalents > $4.3 billion

Q3 2025: Long‑term debt is essentially ZERO 0⃣

Institutional Ownership:

About 70–75% of shares are held by institutional investors (index funds, asset managers). Big players like Vanguard and BlackRock own notable stakes (20% combined). This high institutional ownership reflects Wall Street confidence.

Why HOOD Looks Good 📈📈📈

HUGE Retail Investing Tailwind

HOOD is in the center of the generational shift toward self-directed, mobile investing. They have 25M+ funded accounts that are positioned to benefit as Gen Z and millennials build wealth.

Strong Financials Across the Board

Growing in all key areas, including margins, revenue and cash. Also a balance sheet with zero debt and over $4B in cash

Expanding Product Ecosystem

Retirement accounts, credit cards, and global trading have made HOOD a diversified fintech platform, not just a single-product broker.

Community and Engagement

Their massive user base triggers organic word-of-mouth growth; social, community-driven investing culture builds loyalty and virality.

Brand Power Among Young Investors

HOOD remains the go-to investing app for millennials and Gen Z, defining financial empowerment and easy access to markets.

Why HOOD Can Be Concerning 📉📉📉

Dependence on Rate and Volume Cycles

Over 50% of revenue comes from interest income and trading activity, making results highly sensitive to lower rates or quieter markets.Regulatory and PFOF Risk

The payment-for-order-flow model faces potential regulatory limits that could cut into core revenue streams overnight.Retail Concentration and Volatility

A large portion of users are active traders; earnings could drop sharply if sentiment shifts or retail trading slows during market downturns.High Customer Turnover and Inactivity

Many users open accounts but don’t often trade or move funds elsewhere once hype cools. Overall long-term engagement not there in many cases.

Valuation Concerns

Trailing P/E of roughly 55x earnings, the stock is priced for strong future growth and has little room for error.

Scenario Analysis

Bull Case: HOOD is en route to being a full-fledged digital wealth platform with international reach. Its user base surpasses 35 million funded accounts, from global expansion, product stickiness, and deeper integration across savings, credit, and investing. AI financial tools personalize user journeys, boosting engagement and monetization per customer. With rates stabilizing and retail participation rebounding, HOOD sustains 25%+ annual revenue growth, consistent profitability, and strong free cash flow, making the stock a large cap fintech regular.

Base Case: HOOD matures into a steady-growth fintech brand with moderate expansion and stable profitability. The company grows users in the low double digits while maintaining solid gross margins of 80%+. Interest income and trading activity normalize, but new products like the Gold Card and international expansion offset slower domestic growth. Earnings grow modestly as operating leverage improves, but valuation stays reasonable, with the stock trading around 15–20× earnings as a sustainable, mid-tier player in digital finance.

Bear Case: Retail trading enthusiasm fades, interest income compresses with falling rates, and new products disappoint. Regulatory action on payment-for-order-flow takes away a major revenue stream, forcing HOOD to restructure or pivot. User growth stalls or declines as competitors like Fidelity and Cash App take away younger investors. Profitability weakens, FCF turns negative again, and the stock retraces toward book value, trading as a speculative, low-multiple fintech with uncertain long-term viability.

Zoom Out: 3-5+ Year Outlook

HOOD’s not just a trading app anymore, it’s becoming a full-blown fintech ecosystem. Think investing, saving, credit, and spending all in one place, built for simplicity, accessibility, and ownership. Over the next few years, the goal is to be the go-to money app for a new generation of investors.

What is their edge? Smarter personalization, automation, and rebuilding trust. AI will help guide investment decisions, make tax and wealth planning easier, and clean up some of the reputation damage from previous missteps that lost trust.

International growth will be big, especially with expansion into the UK, EU, and Asia-Pacific. On top of that, products like the Gold Card, IRAs, and the Bitstamp deal should drive steadier, higher-margin revenue.

The risks? Slower user growth, regulatory pressure, or failing to shake off its past. If trust doesn’t bounce back or if execution stumbles, the whole ecosystem push could fall flat or at a minimum be volatile.

Bottom line: If HOOD sticks the landing, it could end up as the default financial app for millions.

By 2030, HOOD might look less like a broker, not quite like a bank, but a new kind of money platform – maybe a hybrid between PayPal, Schwab, and Cash App; a full-stack financial platform, not just a place to trade. Success will be far more than trading volume alone.