CONVICTION

Happy Investors 😃 📈

Most investors can tell you what a company is worth today.

Ask them what it could be worth five years from now, and they get stuck. Not because they don’t care, but because Wall Street made it sound like rocket science.

Investors struggle with this, and the impact is critical. If you can’t value tomorrow, you’ll lack conviction today. That’s what leads to panic selling or taking profits too early because you don’t have the confidence to stick it out.

People use metrics like P/E, PEG, and P/S ratios to judge value, but those are high-level benchmarks. They don’t tell the full picture since the same multiples don’t apply to all businesses, especially high-growth ones.

The stock market rewards growth, but when it comes to forward valuation, the process feels overwhelming; spreadsheets, discount rates, and formulas that make it seem like you need a finance degree.

Today I’ll be simplifying this…

The Unit Economics Method is designed for everyday investors and not Wall Street analysts. It’s a hands-on way to project a company’s potential value by focusing on what matters:

✅ how many customers it can grow to, and

✅ how much profit it earns per customer.

It’s simple and flexible. You can plug in your own numbers, change customer growth, pricing, or margins, and instantly see how that impacts value.

I’ll be using simple numbers (and estimates), so we don’t overcomplicate. You may see me using “profit” loosely, but it means “cash flow” in this example.

Before we dive in, let’s look at how professionals have traditionally been doing this for decades. These methods are great, and I suggest using them if you know how, but the Unit Economics Method is a good way to start if you’re having trouble with these traditional ways…

1) Discounted Cash Flow (DCF) — Intrinsic Value

How it works:

Forecast future cash flows

Back out a discount rate

Bring those future dollars back to today’s value

Add them up > fair value today

Goal: Find the true intrinsic value of a business today based on all the cash it can make in the future

Purpose: Keeps investors disciplined and focused on fundamentals, not hype.

Who uses it: Value investors, financial analysts, corporate managers, private equity.

When to use it: Mature businesses with predictable cash flows (e.g., consumer staples, dividend players).

Challenge: Tiny tweaks (1–2% growth or discount) can swing valuation by billions. Complex to update or adjust on the fly.

2) Relative Valuation (Comps)

How it works:

Compare the company to peers (similar businesses)

Look at multiples (P/E, Price-to-Sales, Price-to-FCF, etc.)

Adjust for growth and risk

Apply peer multiple to your company > implied fair value

Goal: See how the market values similar companies today.

Purpose: Is this stock “cheap” or “expensive” vs others?

Who uses it: Wall Street, portfolio managers, hedge funds, M&A bankers.

When to use it: Fast-moving sectors where future cash flow is hard to forecast (e.g., SaaS, biotech).

Challenge: It’s “relative,” not absolute…if peers are overpriced, your stock can look cheap when it isn’t.

______________

The challenge with both methods is that they’re either too complex or too market-driven.

The Unit Economics Method fixes that. It lets you see the real business engine behind the stock.

Unit Economics Method - The Business Engine

This method gets straight to the logic of growth. Instead of trying to forecast much of a financial statement, you ask:

“How much profit does the company make per customer, and how many more customers can they realistically add?”

That’s it.

It’s an easy way for long-term investors to forward value a company without being buried in formulas.

_________________

The Step-by-Step “Unit Economics Playbook”

Step 1 — Define the “Unit”

Every business has one key economic engine…one “unit” that drives revenue

CrowdStrike: a paying customer

Starbucks: a store

Netflix: a subscriber

Shopify: a merchant

That “unit” is where you measure profitability and scalability. Not all businesses have the same “unit”

Step 2 — Calculate Profit per Unit

Figure out how much profit the company makes from one unit.

You need just a few numbers:

Revenue per unit – Average Revenue Per Unit (ARPU) or Average Order Value (AOV)

Gross margin (what’s left after costs of good/services)

Cash flow per unit

Example:

Revenue per customer = $100K/year

Cash flow per customer (unit) = $30K (roughly 30% cash flow margin)

That’s your profit engine per customer.

Step 3 — Assess the Quality of the Unit Economics

Before scaling, test how durable and efficient that profit is.

Key metrics:

Churn / Retention: Do customers stick around?

LTV (Lifetime Value): How much total profit does one customer produce before leaving?

CAC (Customer Acquisition Cost): How much does it cost to acquire that customer?

Payback Period: How long until that customer’s profit repays its acquisition cost?

Each industry can fluctuate, but here’s the “rule of thumb” for healthy Unit Economics:

✅ Low churn

✅ LTV/CAC = 3x plus

✅ Payback within 12 months

If these are strong, the company can likely scale without burning cash.

Green Flags

High retention, expanding ARPU (customers buy more over time)

Short payback period, strong LTV/CAC (>3× is great)

Rising gross margins and operating leverage (profits scale faster than costs)

Large, under-penetrated obtainable market (room for units to multiply)

Red Flags

High churn or heavy discounts needed to close deals

Payback periods creeping longer, CAC rising faster than ARPU

Unit economics only look good at massive scale

“Growth” that’s mostly price cuts or promotions

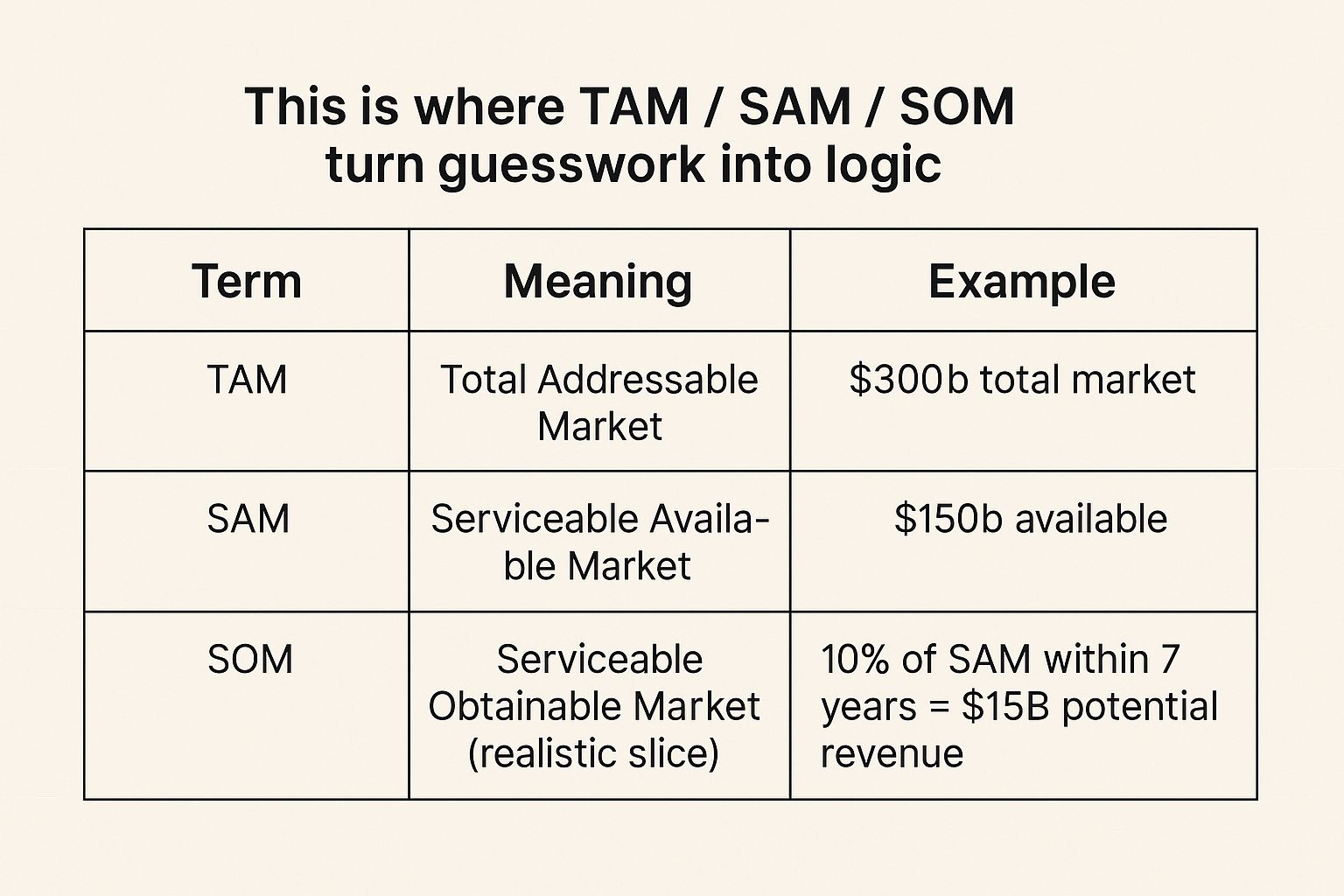

Step 4 — Estimate Future Potential

Realistically, how many more of these customers can they add?

At $15b revenue x 30% margin $4.5 billion profit

$4.5b profit / $30k per customer = 150K possible customers.

That’s your realistic ceiling if they execute on 10% of the SAM

Step 5 — Build the Cash Engine (Units × Profit per Unit)

Now you scale it out:

Time | Customers | Profit/Unit | Total Cash Flow |

Today | 30k | $30k | $900 million |

7 Years | 150k | $30k | $4.5 billion |

That’s your forward free cash flow path. That’s a 5x in customers & cash flow from where they are today assuming the same margins of 30%. Now, if they increase their profits per unit, the numbers can change for the better.

If a business’s free cash flow grows from $900 million to $4.5 billion in 7 years, it’s compounding around 26% a year, meaning it’s growing its cash flow by roughly one-quarter more than the year before.

That’s very strong growth, and at that pace, the business roughly doubles its cash flow every 3 years.

Let’s take CrowdStrike…they have just over 30k paying customers. If they reach 150K over the next decade with similar margins, their profit engine could 5x.

But for this to make sense, we need to know what the company is trading at today…

Step 6 — Apply a Multiple and Compare to Today

Apply a fair market multiple (based on peers).

If peers trade at 20× free cash flow:

$4.5b cash flow × 20 = $90b fair value

If their current market cap is $80b, then the markets have already priced in most of their growth.

If your model shows a future value much higher than today’s price, then that’s potential upside.

Let’s say their current market cap is $25b, then the business looks much better assuming they execute as shown above.

Quick Recap

Step | Focus | Key Question |

1 | Define the Unit | What drives revenue? |

2 | Profit per Unit | How much do they earn per sale (customer, store, etc) |

3 | Unit Economics | Are these profits durable and scalable? |

4 | Market Potential | How many units can we add over time? |

5 | Build the Cash Engine | What’s total profit at scale? |

6 | Valuation & Comparison | Is today’s price cheap or rich? |

Why it Works

It’s simple — no complicated math.

It’s flexible — you can adjust customer growth, margins, or pricing.

It’s visual — you can literally see how profit per customer and number of customers drive value.

It’s realistic — it focuses on 5 to 10 years, not 30+.

It’s the bridge between how a business grows and what that growth is worth.

Investor Lens: Deciding If It’s a Good Buy Today

Build a conservative 5 to 10 year unit story (units × profit per unit).

Translate to cash engine (a proxy for FCF).

Apply a grounded multiple (peers + quality + growth).

Compare implied future value to today’s market cap.

Back into annualized return. If it clears your hurdle with conservative inputs, you’ve got room for upside. If you need aggressive assumptions to get a decent return, it’s probably priced for perfection.

The goal isn’t to be perfect, it’s not possible to forecast to the penny. You’re trying to understand what’s already priced in and the growth potential.

If today’s price assumes perfection, your return potential shrinks.

If today’s price leaves room for upside, meaning your conservative scenario still gives you 12–15% annual returns, then you’ve got a deal worth holding.

Bottom Line

*DCF tells you what the future is worth today. Values the business.

*Relative Valuation (Comps) tell you how the market is pricing similar stories. Values the markets opinion.

*Unit Economics tells you whether the engine is strong enough to make that future happen and whether you’re paying a good price today for the next 5 to 10 years of scaling.

Your Turn…

Try picking one company you own or follow. Estimate its “unit,” profit per unit, and potential customer growth. You’ll start seeing whether it’s priced for perfection or still has room to run.

Once you’ve built confidence with Unit Economics, layer it into a basic DCF.

You’ll already have the cash flow estimates, so the rest is just discounting them back. This is how you go from “thinking like an investor” to valuing like one.

A Simple Template (fill in the blanks)

Today

Units today: ___

Profit per unit today: $___

Today’s cash engine: Units × Profit per unit = $___

5 to 10 years

Units in 5 yrs (conservative): ___

Profit per unit in 5 to 10 yrs (conservative): $___

Future cash engine: $___

Apply multiple (e.g., 20×): Implied future value = $___

Annualized return check: From today’s value > Future implied value __%/yr

Happy Investing,

Ralph D.